Taking a non-public mortgage can be a beneficial monetary decision while you need money for emergencies, home repairs, schooling, medical costs, or some other crucial reason. However, many people rush into borrowing with out know-how how loans simply work. This frequently ends in high month-to-month bills, useless hobby, and lengthy-term financial strain.

To assist you are making a clever and informed decision, right here are the maximum critical belongings you need to always do not forget earlier than applying for a private loan.

1. Understand Why You Truly Need the Loan

Before whatever else, ask yourself one simple query:

“Do I actually need this mortgage?”

A private loan have to only be taken whilst:

The expense is critical

There isn’t any better financial option

You can manage to pay for to pay off it without difficulty

Many human beings take loans for non-important reasons which include luxury shopping, upgrading a telephone, or happening vacation. This can create pointless economic strain later. A loan is beneficial best when it solves a actual trouble—now not whilst it creates new ones.

2. Compare Interest Rates Carefully

One of the biggest mistakes debtors make isn’t always evaluating interest fees from one-of-a-kind banks. Even a 1–2% difference in interest can substantially impact how an awful lot you pay in the long run.

Always compare:

Annual hobby rate (APR)

Fixed vs. Variable interest

Any more carrier costs

A slightly decrease hobby charge can prevent a number of cash over time, so in no way bypass this step. Take rates from as a minimum three–five banks or monetary institutions earlier than you decide.

Three. Choose the Right Loan Tenure

Loan tenure way the time you get to repay the mortgage.

Longer tenure: Smaller month-to-month installments however extra total interest

Shorter tenure: Higher monthly payments but less general interest

It’s important to choose a repayment length that suits your month-to-month finances while preserving the overall cost low.

A appropriate rule is to pick out a tenure that allows you to make bills effectively without taking financial stress each month.

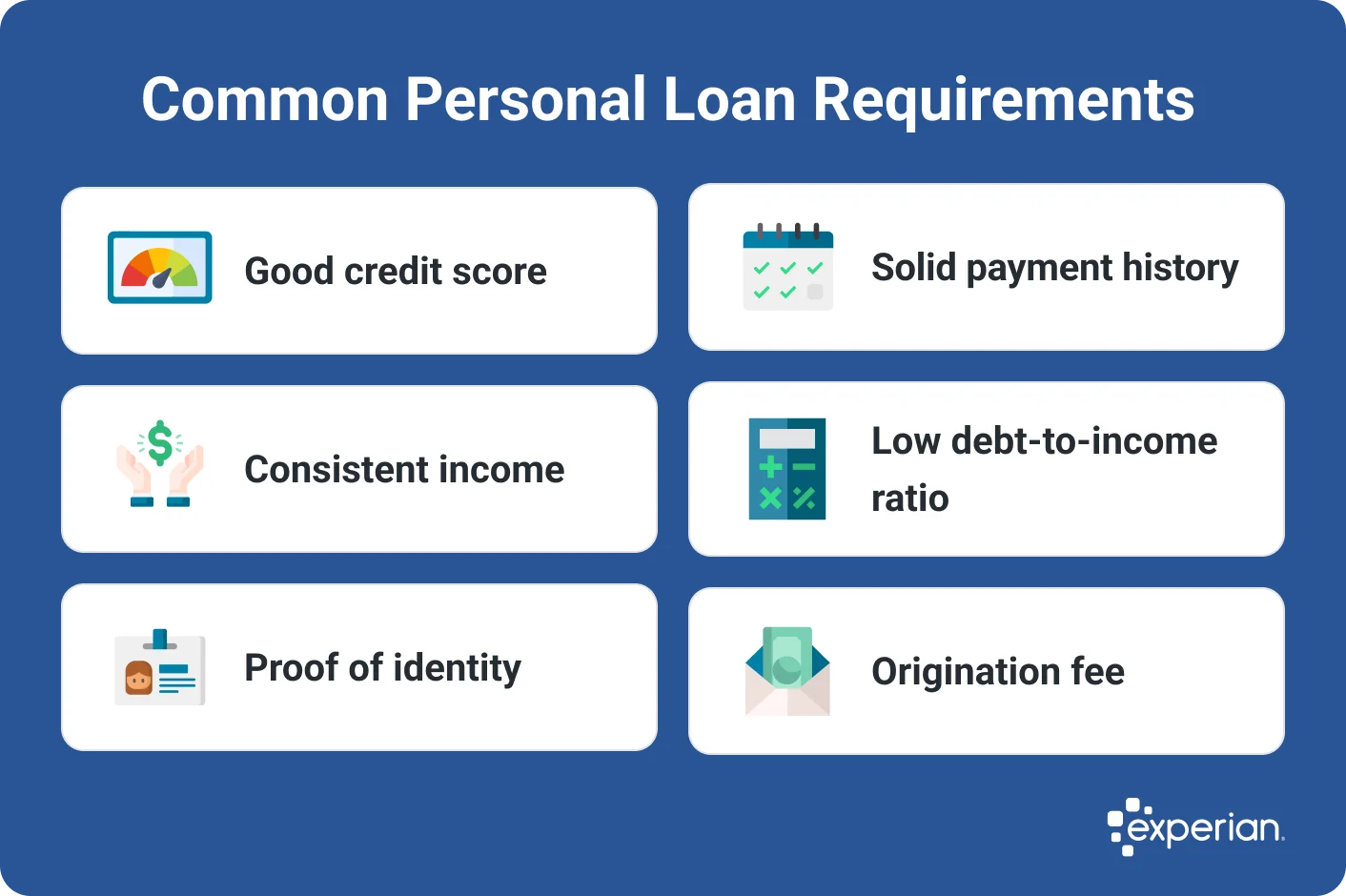

Four. Check Your Credit Score Before Applying

Your credit rating performs a primary role in loan approval. A excessive rating way you have a strong history of paying bills on time, which makes lenders believe you greater.

A good credit score score helps you get:

Faster loan approval

Lower hobby quotes

Better loan offers

If your rating is low, bear in mind enhancing it first with the aid of paying off antique bills or clearing credit card balances. This small step will let you save heaps in interest.

5. Make Sure the Monthly Installments Fit Your Budget

Many humans take loans with out calculating how a good deal their month-to-month installment (EMI) could be. This creates monetary strain later.

Your EMI need to by no means exceed 30% of your month-to-month income.

Before making use of, ask your self:

Can I simply pay this EMI each month?

Will I nonetheless be able to manage savings, payments, and other prices?

What if my profits changes or an emergency happens?

If the EMI feels too high, don’t forget deciding on an extended tenure or borrowing a smaller amount.

6. Understand All Hidden Charges

Every mortgage comes with greater fees that maximum people by no means notice until it’s too overdue.

Common hidden fees include:

Processing prices

Insurance fees

Late fee consequences

Early agreement charges

Documentation expenses

Always ask your lender for a complete breakup of all prices. Knowing the very last overall quantity you will repay helps you make a clear and honest choice.

7. Read the Terms and Conditions Carefully

Most humans without a doubt signal the loan settlement with out reading it. This can be volatile due to the fact the agreement incorporates essential information about:

Interest calculations

Late payment rules

Prepayment penalties

Annual costs

Requirement of guarantors

Take a while and examine the whole lot. If whatever is uncertain, ask the financial institution consultant to explain it. Understanding the agreement protects you from surprising surprises within the future.

Eight. Use an EMI Calculator Before Applying

An EMI calculator is one of the best tools you can use to check:

Monthly installment amount

Total interest payable

Final repayment quantity

Most banks provide EMI calculators on line free of charge. Using one enables you understand whether or not the mortgage is lower priced and how it fits into your lengthy-term financial making plans.

9. Beware of Fraudulent Loan Apps

In many nations, a lot of fake loan apps function illegally. They may additionally fee extremely excessive interest rates, misuse your personal information, or add hidden fees after approval.

To guard yourself, best borrow from:

Registered banks

Licensed economic establishments

Well-regarded mortgage companies

Always take a look at evaluations, ratings, and official registrations earlier than sharing your private data.

10. Borrow Only What You Need

It may be tempting to take a better mortgage amount due to the fact the financial institution approves it, however keep away from doing that. A higher loan means:

Higher month-to-month installments

More interest

Increased monetary strain

Borrow best the amount you sincerely need. Responsible borrowing facilitates you preserve monetary stability in the long run.